Paying Yourself First

How To Get Started

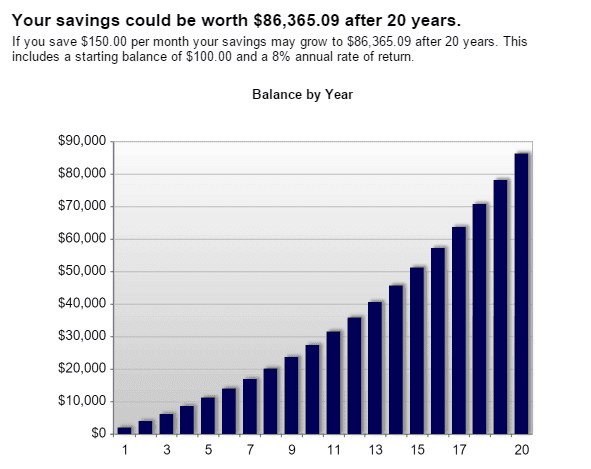

When starting out, starting small is always a good idea until you are used to paying yourself first and understand finances better. 3-5% is a good portion of your paycheck to set aside at the beginning since it is a very small percentage and one will not notice that missing portion of their pay. Another tip is to automate, this means having the bank transfer the percentage of the paycheck you want to go into saving without you having to do it yourself. By automatically deducting a portion of your paycheck to go directly into savings one will not miss the money they earned since you will not know it is gone. Also you will not be tempted to spend that money since it is in a secure savings account. As shown on the graph above putting your money into a high interest savings account is the best way to get rich slowly. By using a high interest savings account and depositing once a month the money will collect interest on interest allowing the money to sit a grow. Unlike depositing a set amount at the end of the year because this money will not collect the interest ,that allows the money to grow, as fast as depositing once a month.

When starting out, starting small is always a good idea until you are used to paying yourself first and understand finances better. 3-5% is a good portion of your paycheck to set aside at the beginning since it is a very small percentage and one will not notice that missing portion of their pay. Another tip is to automate, this means having the bank transfer the percentage of the paycheck you want to go into saving without you having to do it yourself. By automatically deducting a portion of your paycheck to go directly into savings one will not miss the money they earned since you will not know it is gone. Also you will not be tempted to spend that money since it is in a secure savings account. As shown on the graph above putting your money into a high interest savings account is the best way to get rich slowly. By using a high interest savings account and depositing once a month the money will collect interest on interest allowing the money to sit a grow. Unlike depositing a set amount at the end of the year because this money will not collect the interest ,that allows the money to grow, as fast as depositing once a month.

Why You Should Start Paying Yourself First Now

Though one associates paying yourself first with the future and saving for retirement, starting as soon as you can is the best option in order to increase your long term savings. As a teenager saving for university is a big expense and by setting aside $25 dollars a month (the price of a cheap cell phone plan) into savings the money will collect interest and the gap between university and your personal fiances will not be as big if you did not save. Though I do not have a job yet when I do I will practice paying yourself first in order to increase my personal fiances.

http://www.investopedia.com/terms/p/payyourselffirst.asp

http://moneycoachescanada.ca/blog/paying-yourself-first/

http://moneycoachescanada.ca/blog/paying-yourself-first/

http://www.getrichslowly.org/blog/2009/10/19/pay-yourself-first/

http://www.getrichslowly.org/blog/2008/06/16/personal-finance-made-easy-pay-yourself-first/

http://www.getrichslowly.org/blog/2008/06/16/personal-finance-made-easy-pay-yourself-first/