Pay yourself first is a phrase commonly used in personal finance that means to automatically route your specified savings contribution from each paycheck at the time it is received.

In simple words, it means putting money into your savings accounts first (as soon as you earn it), before you spend it on anything else.

When you pay yourself first, you are mentally establishing saving as a priority. Most people spend in this order: bills, fun, saving. In most cases there is not much left over to put in the bank. If you pay yourself first and give saving your number one priority, you can already have some money set aside, before you think about spending it on something else.

Pay Yourself First is not only important for adults, but also for teenagers and young adults. Once you start early, you can save for the future and have money saved for emergencies, education, etc.

Tips For Teens

- It is okay to start small. You can increase the amount you save as you begin to feel more confident in your income. Try starting with $40 each month or 1% of your paycheque. As you feel more comfortable in your ability to save, try increasing your saving rate to 3% or even 5% of your income and build from there.

- The most convenient way to start saving is to set up an automatic transfer on pay day from your bank account directly into savings. Automatic saving can be set up online and this will make sure you don't forget or get lazy.

- It is better to start saving when you are still in school, and don't have to spend a lot of money on bills, mortgage or taxes. This ensures that majority of the money is actually being saved and you are also not under pressure from loans/other payments.

Next Steps

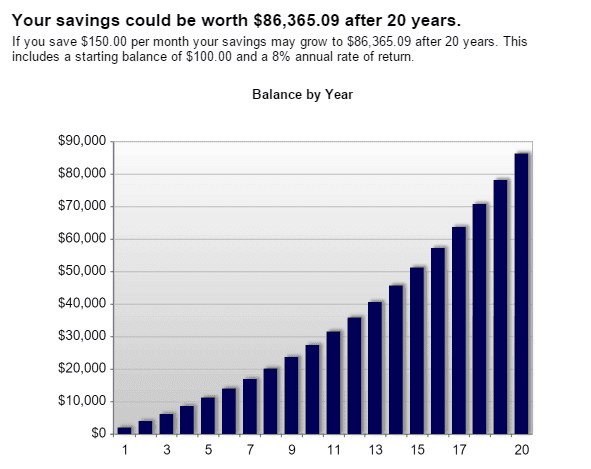

Once regular savings has become a habit, you can use this trick for your short term goals as well. You can also now decide how and where you want to save your money. Types of Investments/Places to save

- Savings Account- the safest and easiest place to save your money when you are new to the concept of saving. Almost every bank offers savings accounts and they allow you to keep your money in a safe place while it earns a small amount of interest each month.

- RESP- Registered Education Savings Plan , is a special savings account for parents who want to save for their child's education after high school. You can also contribute to this, by putting your savings in this account. The Government adds up to 20% to your RESP to help the savings grow.

- RRSP- Later on as I get older, I can save my money in a Registered Retirement Savings Account, which is a retirement savings plan to which you can contribute money to for your future and for when after you stop working. Any income you earn in the RRSP is usually exempt from tax as long as the funds remain in the plan; you generally have to pay tax when you withdraw money.

- TFSA- Tax Free Savings Account : an investment account that can help you meet both your short- and long-term goals. Its for individuals who are 18 and older and who have a valid social insurance number to set money aside tax-free throughout their lifetime. Contributions to a TFSA are not deductible for income tax purposes. This comes in handy in times of emergencies, because you can take out money without paying tax.

Overall, pay yourself first, is an important technique that everyone should be using in order to save money for emergencies or for their future.

http://www.stableinvestor.com/2013/03/pay-yourself-first.html

http://www.investopedia.com/terms/p/payyourselffirst.asp

http://www.esdc.gc.ca/en/student_grants/cesg.page

http://www.debtroundup.com/saving-investing-compound-interest-millions/

http://moneycoachescanada.ca/blog/paying-yourself-first/

http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/rrsp-reer/rrsps-eng.html

I really enjoyed reading this blog, first off. You covered many areas which included information many people should be aware of. You used great images, graphs, and statistics that add even more to your blog. I enjoyed how detailed your blog was as well, as it felt like i was actually being taught something, and not just reading. My only piece of criticism is that the font of your paragraphs is really small, and makes it a tad strenuous to read. But other than that, great job.

ReplyDelete